By José Dumont Neto, Esq.1

1. SCOPE:

This article demonstrates that Brazilians with legitimate intentions to legally avoid reporting under both the U.S. Foreign Account Tax Compliance Act (“FATCA”), and the Common Reporting Standards (“CRS”) promulgated by the Organization for Economic Cooperation and Development (“OECD”), should consider the United States of America and its offshore territories (“United States” or “U.S.”) as an appropriate jurisdiction for tax planning, privacy, and asset protection.

2. ATTENTION!

Be advised that tax evasion is a crime in Brazil pursuant to Law no. 8,137/1990.

3. TO WHOM DOES THIS ARTICLE APPLY?

This article applies to Brazilians2 considered, under U.S. tax concepts, to be “non-U.S. persons.” The U.S. Internal Revenue Code defines a non-U.S. person in the negative as a person not considered to be a “U.S. person”. The term “U.S. person” includes, but it is not limited to, the following: (i) a citizen of the U.S., including an individual born in the U.S. but who is a resident in another country (and who has not given up U.S. citizenship); (ii) a person residing in the U.S., including U.S. permanent residents (“green card holders”); (iii) persons who spend a significant number of days in the U.S. each year (usually, on average, more than 121 days per year under the “substantial presence test”); and (iv) corporations formed in the U.S., U.S. domestic partnerships and limited liability companies, U.S. estates and U.S. trusts.

4. AGREEMENTS TO AUTOMATICALLY EXCHANGE INFORMATION:

Agreements to automatically exchange information are mainly designed to prevent tax evasion by ensuring that taxpayers pay the right amount of tax to the competent jurisdiction. Due to their relevance, scope, and actual worldwide implementation, this article focuses on two regulatory schemes that directly impact the disclosure of bank information and personal data protection: FATCA and CRS.

4.1. FATCA

According to the U.S. Internal Revenue Service (“IRS”),3 FATCA is an important development in U.S. efforts to combat tax evasion by U.S. persons holding assets offshore.

Under FATCA, reporting institutions are required to provide information to the IRS regarding financial assets and/or substantial ownership interests held outside the United States by a U.S. person. The reporting institutions include, but are not limited to, banks, investment entities, brokers, and insurance companies. Entities deemed “non-U.S. reporting institutions” that do not obey the reporting requirements of FATCA are subject to a 30% withholding tax on many types of income payable to them by U.S. persons including, but not limited to interest, dividends, investment advisory fees, custodial fees, bank or brokerage fees, insurance or annuity premiums, and various types of financial contracts.

Because secrecy laws and personal data protections would restrict or prohibit non-US reporting institutions to comply with FATCA, it was necessary to convince foreign jurisdictions to change their domestic laws. Under the rationale that the fight against tax evasion brings benefits to all involved jurisdictions, the IRS released a form of Intergovernmental Agreement (“IGA”) providing both the United States and the respective foreign FATCA partner (“FATCA Partner”) the obligation to reciprocally4 exchange relevant information on foreign-owned accounts and investments.

However, such obligation to reciprocally exchange information is not fully “reciprocal.” As demonstrated below, the United States collects more detailed information than it actually provides to FATCA Partners.

4.1.1. THE “RECIPROCAL” OBLIGATION TO EXCHANGE INFORMATION

The United States appears to have acknowledged that some FATCA Partners need an incentive to change their domestic laws regarding bank secrecy and personal data protection in order to be in a position to actually provide to the United States the information required under FATCA IGAs. One such incentive is for the United States to provide information to its FATCA Partners similar to what it requires to be provided by its FATCA Partners.

The United States expressly sometimes does acknowledge the need to achieve equivalent levels of reciprocal automatic information exchange between countries. For example, Article 6 of the IGA between Brazil and the United States (“IGA Brazil-USA”)5 provides:

The Government of the United States acknowledges the need to achieve equivalent levels of reciprocal automatic information exchange with Brazil. The Government of the United States is committed to further improve transparency and enhance the exchange relationship with Brazil by pursuing the adoption of regulations and advocating and supporting relevant legislation to achieve such equivalent levels of reciprocal automatic information exchange.

While, the United States thus expressly recognizes that it provides non-equivalent levels of information to Brazil, what exactly is it that is not reciprocally exchanged between the countries? Here is an example that relates to reportable bank account information:

Information reported by Brazil

Article 2 –The information to be obtained and exchanged is:

In the case of Brazil, with respect to each U.S. Reportable Account of each Reporting Brazilian Financial Institution:

(1) the name, address, and U.S. TIN of each Specified U.S. Person that is an Account Holder of such account and, in the case of a Non-U.S. Entity that, after application of the due diligence procedures set forth in Annex I, is identified as having one or more Controlling Persons that is a Specified U.S. Person, the name, address, and U.S. TIN (if any) of such entity and each such Specified U.S. Person;

Information reported by the United States

Article 2 –The information to be obtained and exchanged is:

In the case of the United States, with respect to each Brazilian Reportable Account of each Reporting U.S. Financial Institution:

(1) the name, address, and Brazilian CPF/CNPJ of any person that is a resident of Brazil and is an Account Holder of the account;

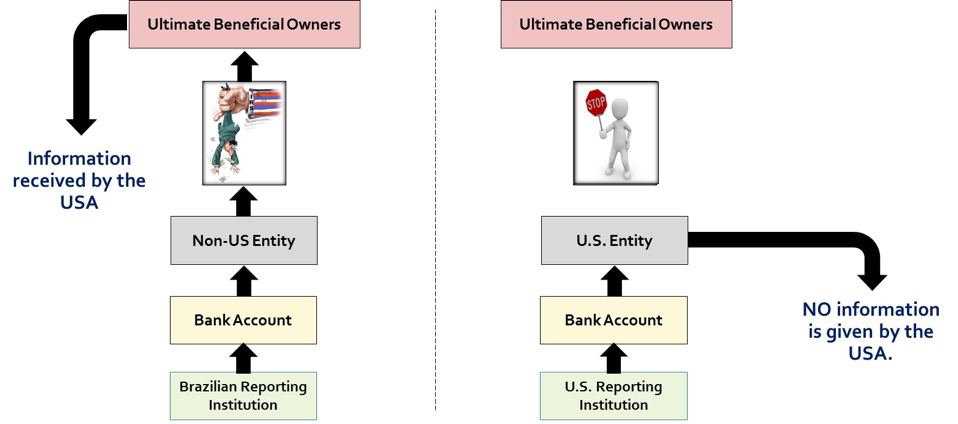

A simple comparison of the above language reveals that the United States is significantly less burdened than Brazil regarding the information to be exchanged between the countries in respect of bank accounts and their ultimate beneficiaries.

The Brazilian reporting institutions must report all relevant information concerning the U.S. account holder and, if necessary, proceed with due diligence to identify the ultimate U.S. person controlling the reported asset. On the other hand, the U.S. reporting institutions only are required to report the account holder’s name, address and taxpayer number (CPF/CNPJ), regardless of the ultimate beneficiary of the account. There is no need for the U.S. reporting institutions to undertake due diligence to identify ultimate beneficiaries and/or controlling persons of potential reportable accounts.

Similarly, the difference in requirements for each country may also be shown by simply comparing the meaning of “reportable accounts” under the definitions section of IGA Brazil-USA:

Information reported by Brazil

Article 1 – For purposes of this agreement and any annexes thereto (“Agreement”), the following terms shall have the meanings set forth below:

The term “U.S. Reportable Account” means a Financial Account maintained by a Reporting Brazilian Financial Institution and held by one or more Specified U.S. Persons or by a Non-U.S. Entity with one or more Controlling Persons that is a Specified U.S. Person. Notwithstanding the foregoing, an account shall not be treated as a U.S. Reportable Account if such account is not identified as a U.S. Reportable Account after application of the due diligence procedures in Annex I.

Information reported by the United States

Article 1 – For purposes of this agreement and any annexes thereto (“Agreement”), the following terms shall have the meanings set forth below:

The term “Brazilian Reportable Account” means a Financial Account maintained by a Reporting U.S. Financial Institution if: (i) in the case of a Depository Account, the account is held by an individual resident in Brazil and more than $10 of interest is paid to such account in any given calendar year; or (ii) in the case of a Financial Account other than a Depository Account, the Account Holder is a resident of Brazil, including an Entity that certifies that it is resident in Brazil for tax purposes, with respect to which U.S. source income that is subject to reporting under chapter 3 of subtitle A or chapter 61 of subtitle F of the U.S. Internal Revenue Code is paid or credited.

As a result, the U.S. reporting institutions are obligated to report only depository accounts held by individuals and non-depository accounts with U.S. source income (e.g. U.S. securities). This means, for example, that depository accounts in the USA held through entities are not reportable to Brazil and there is no need for due diligence to be conducted. On the other hand, Brazil must report depository accounts held by U.S. persons (individuals and/or entities) ultimately identified by mandatory due diligence procedures. For illustration purposes of the asymmetrical information exchanged between the United States and Brazil, please see below:

The United States essentially provides superficial information regarding reportable assets and its holders although it receives information obtained through a due diligence process. Hence, the obligation to exchange information is not “reciprocal.”

Based on such an asymmetrical obligation to exchange information, it is fairly simple to structure one’s affairs to legally avoid reporting to foreign countries under FATCA.

4.1.2. CAN BRAZILIANS AVOID REPORTING UNDER FATCA?

The previous section of this article discussed situations in which the United States either does not provide any information at all to Brazil regarding assets booked in the United States, or it provides information solely at a superficial level if U.S. source income is present.

Due to such “non-reciprocal” obligations, avoidance of FATCA with respect to Brazilians may be quite easy. A Brazilian whose intention is to legally avoid the disclosure of personal information under FATCA can simply hold an account in a U.S. financial institution through a domestic U.S. entity (in case of depositary accounts) or assure that no US-source income is earned if a non-depositary account is held.

Therefore, a Brazilian whose intention is to legally avoid the disclosure of personal information under FATCA is well advised to explore the non-reciprocal obligations under the IGA Brazil-USA and structure his or her affairs accordingly.

4.1.3. WILL THE IGA BECOME TRULY RECIPROCAL IN THE NEAR FUTURE?

Is it possible or likely that the IGA Brazil-USA will become truly reciprocal in the near future? Although of course we can not know for sure, there are at least two good reasons why it is unlikely that the IRS will provide additional information under IGA Brazil-USA in the short run.

The first reason is because it is expensive to do so. The exchange process requires: (i) development of a consistent data reporting format and the agreement to use this format by all jurisdictions with IGAs; (ii) creation of a data transmission system to meet high standards for encryption and security; and (iii) establishment of the details and procedures required to assure data confidentiality.

Second, and perhaps more important, it will take political capital in the United States to pass legislation requiring additional disclosure by U.S. financial institutions. One reason for this is that genuine reciprocal treatment between the United States and FATCA Partners like Brazil is likely to reduce the current competitive advantage for U.S. banks which do not have to provide fully reciprocal information uner FATCA.

Consequently, fully reciprocal treatment between the United States and Brazil will likely not take place any time soon. Therfore we would expect that the technique to avoid reporting under FATCA which is described in section 4.1.2 above, may be expected to be used by Brazilians for a long time.

4.2. CRS

Members of the OECD adopted a similar, but stricter, version of FATCA: the CRS.

Although both FATCA and CRS call for the automatic exchange of information on an annual basis, CRS is more detailed than FATCA in regard to the financial institutions required to report, the different types of accounts and taxpayers covered, and due diligence procedures to be taken by the reporting institutions.

CRS is either already in effect, or will soon become effective, in nearly all of major countries in the world. According to the OECD6, as of December 2016, there were already over 1,300 bilateral exchange relationships established under CRS with respect to 87 jurisdictions actively committed to the program. In the specific case of Brazil, the first exchange of information shall occur in 2018 regarding 2017 data.7

4.2.1. CAN BRAZILIANS CIRCUMVENT REPORTING UNDER THE CRS?

Taking into account that there over 1,300 bilateral exchange relationships with respect to 87 jurisdictions actively committed to the CRS, one should think that it is very hard to avoid reporting under CRS. Is this correct?

Not necessarily! Surprising as it may seem to some, the United States has not signed the CRS. Therefore, a Brazilian may avoid reporting under CRS by using holding structures and financial institutions both located in the United States.

More specifically, if a Brazilian holds all of his or her assets in a financial institution in the United States through a holding structure located in the United States or one of its territories, the CRS would be inapplicable.

By contrast, a structure with assets held outside the United States in a jurisdiction participating in CRS might not prevent reporting obligations under CRS. For example, entities in the United States, such as trusts, which own assets located offshore might be subject to look-through reporting by financial institutions of participating jurisdictions. Thus, in such a structure, assets should be held in the United States by a United States person, i.e., an entity formed under the law of one of the states or territories of the United States. Otherwise a non-US financial institution in a participating jurisdiction might have its own reporting obligation regarding the assets regardless of whether or not the assets are held by an entity in a non-participating jurisdiction such as the United States.

4.2.2. SO FAR, SO GOOD. BUT WHEN WILL THE UNITED STATES JOIN THE CRS?

It is not likely that the United States will join the CRS at any time in the forseeable future because foreign investments and account information of U.S. persons is already being collected and reported to the IRS through FATCA. Furthermore, it is unlikely that the U.S. Congress or the current administration will move to expand IRS authority with respect to agreements entered into with foreign jurisdictions.

5. IDEAL STRUCTURES TO AVOID REPORTING UNDER BOTH FATCA AND CRS:

As explained in section 4.1.2 above, a Brazilian does not have to be concerned about FATCA if the account is held by an entity deemed to be a U.S. person that does not receive U.S. source income, regardless of who is the ultimate beneficiary.

As explained in section 4.2.1, CRS reporting is avoidable if assets are held in a financial institution in the United States through a holding structure that is not deemed to be a reporting institution in a CRS participating jurisdiction.

Combining the information in sections 4.1.2 and 4.2.1, reporting under FATCA is avoided if, for example, a Brazilian holds an account through a trust resident in the United States; and CRS reporting is also avoided if all assets are held in a U.S. financial institution (which is not obligated to report under CRS) by the U.S. resident trust, which itself is not deemed to be a reporting institution in a CRS participating jurisdiction.

So given that there exists a potential structure that may avoid reporting under both FATCA and CRS, the next question is: Since the assets are held in a U.S. financial institution by a trust also resident in the United States, will the investments be subject to a very high taxation in the United States?

The answer with respect to many types of income is “yes”, but there is also a solution for that. There are hybrid entities deemed to be non-US residents for tax purposes while still qualifying as U.S. resident for all other purposes. In fact, it is easy to set up a U.S. trust for purposes of avoiding CRS which is not a resident for tax purposes and therefore is not subject to worldwide taxation under U.S. tax rules.

For example, under U.S. Treas. Reg. § 301.7701-7, a trust whose trustee is a U.S. person is treated as resident in the United States for CRS purposes, but would not be treated as resident in the United States for tax purposes if there is another person who is a non-U.S. person who can veto decisions of the trustee. Note that this type of trust will still be treated as a U.S-resident whether or not for tax purposes it is also treated as resident in a participating jurisdiction, e.g. Cayman Islands, British Virgin Islands, Bermuda, etc.

What then is an ideal example of a structure for a Brazilian whose intention is to legally avoid reporting under both FATCA and CRS? The answer: A trust resident in the United States, but structured as a non-U.S. trust for tax purposes and with all assets held in a U.S. financial institution. In many cases, such a structure may also include an underlying domestic (i.e., U.S.) holding company owned by the trust.

This type of trust could be resident in one of the U.S. territories – such as in the United States Virgin Islands (“USVI”) – in case there is any additional reporting concern about the Tax Information Exchange Agreement between Brazil and the United States (“TIEA”). As explained below, the USVI is one of the U.S territories although it has its own tax system administered separately from the IRS and it is not subject to either FATCA or CRS and thus has minimal disclosure requirements.

6. TIEA

Although signed in 2007, the TIEA entered in force only in 20138 following Brazil’s efforts to implement FATCA. The TIEA solely provides for the exchange of information upon a request (not on an automatic basis) relating to a specific criminal or civil tax matter under investigation. In contrast to FATCA and CRS, there is no automatic exchange of information regarding financial assets or bank accounts contained in the TIEA.

The requesting party (either Brazil or the United States) must follow a strict set of rules to request the information under TIEA. Any request for information made by one of the countries must be framed with the greatest degree of specificity possible. In reality, such requests must specify in writing all of the following: (i) the identity of the taxpayer whose tax or criminal liability is at issue; (ii) the period of time with respect to which the information is requested; (iii) the nature of the information requested and the form in which the requesting party would prefer to receive it; (iv) the reasons for believing that the information requested may be relevant to the tax administration and enforcement of the requesting party; (v) to the extent known, the name and address of any person believed to be in possession or control of the information requested; (vi) a statement as to whether the requesting party would be able to obtain and provide the requested information if a similar request were made by the requested party; and (vii) a statement that the requesting party has pursued all reasonable means available in its own territory to obtain the information, except where that would give rise to disproportionate difficulty.

If the rules have not been followed, the request for information can be declined, since these rules are designed to protect confidentiality and guard against “fishing expeditions” (i.e., a tax authority looking for general information, with a mere hope that it may be useful). The only documents or information to be disclosed by the requesting party are those within the specific range set forth in the request.

In this context, the real application of the TIEA is substantially narrower than under FATCA. Even if one’s concern is whether, under the TIEA, it is possible to disclose the identity of the beneficial owner of an entity resident in a U.S. territory,9 domestic rules in the USVI may avoid such disclosure. For example, there are no requirements for an agent of a company in the USVI, or a trustee located there, to identify or disclose information about the beneficiaries of a trust who, in many cases, may not even be named in the trust instrument.

Accordingly, structures similar to the one mentioned in section 5 (a U.S. resident trust deemed to be a non-U.S. trust for U.S. tax purposes) are likely to be outside the scope of the TIEA.

7. ANTI-AVOIDANCE RULES:

There also exist anti-avoidance rules to prevent a person from adopting practices intended to illegally circumvent the reporting obligations under FATCA and CRS. Most of these rules have been promulgated to assist in the effort to fight against tax evasion and related crimes (e.g., money laundering). Each FATCA Partner and/or CRS participating jurisdiction applies different anti-avoidance rules according to specific facts and circumstances. A discussion of these rules is beyond the scope of this article.

8. CONCLUSIONS:

This article demonstrates that the United States is a good jurisdiction for tax planning, asset protection, privacy, and data protection. But how can Brazilians achieve these legitimate goals under FATCA and CRS?

First, bank and investment accounts should be held in U.S. financial institutions because such institutions do not have any CRS reporting obligations. The assets should be held through a holding structure because the United States does not require beneficial ownership reporting under FATCA “reciprocal” obligations.

Second, the holding structure of accounts and investments should involve a U.S. resident entity, for example, one established in the USVI. If properly established, the holding structure will not be deemed resident in the United States for tax purposes.

An example of an ideal structure for a Brazilian considering both FATCA and CRS is to have a USVI trust structured as both a non-U.S. trust and a non-USVI trust for tax purposes. All assets owned by the trust should be held in a U.S. financial institution or a USVI financial institution, often by way of a U.S. or USVI holding company owned by the trust.

*******************

July, 2017

About Solomon Blum Heymann LLP

Solomon Blum Heymann LLP is a commercial law firm based in New York City and the U.S. Virgin Islands. The firm solves problems for domestic and international businesses, trusts, estates, partnerships, foundations, entrepreneurs, individuals, and their families, and provides skilled counsel for complex financial and legal transactions and disputes in the U.S. and abroad. The firm’s core competencies include international and domestic tax, business and commercial law, international law, mergers and acquisitions, intellectual property, corporate compliance, asset protection, estate planning, real estate, and commercial and trust and estates litigation.

1 Mr. Dumont earned a Masters of Laws (LL.M) in International Taxation from the University of Florida, Fredric G. Levin College of Law in Gainesville, Florida, a Post-Graduate degree in taxation from Escola de Direito de São Paulo da Fundação Getúlio Vargas in São Paulo, Brazil, and a Bachelor’s Degree in Law (LL.B) from Pontifícia Universidade Católica De São Paulo in São Paulo, Brazil. He is currently a foreign associate with Solomon Blum Heymann LLP in New York, NY and later in 2017 he plans to be affiliated with Miguel Neto Advogados of São Paulo, Brazil. Both firms are members of the Interlegal network of law firms (www.interlegal.net).

2 While this article focusses on Brazil and Brazilian taxpayers, and uses Brazilian examples, the concepts it discusses are equally applicable to most other jurisdictions in Latin America and worldwide that have adopted CRS and have entered into bilateral exchange relationships under CRS.

3 https://www.irs.gov/businesses/corporations/summary-of-fatca-reporting-for-u-s-taxpayers

4 FATCA is still in place under nonreciprocal agreements with countries that have no interest in receiving information.

5 For Brazilian purposes, FATCA is essentially ruled by Decree no. 8,506/2015 and Normative Regulation no. 1,571/2015.

6 http://www.oecd.org/tax/automatic-exchange/international-framework-for-the-crs/

7 Information regarding the implementation of the CRS by Brazil can be found at Normative Regulation no. 1.680/2016.

8 Decree 8,003/2013.

9 By their terms, IGAs do not cover the U.S. territories, including the USVI. This is because the territories are not included in the definition of “United States” under FATCA or the IGAs, while some of the TIEAs (including the one signed with Brazil) do include the Territories in the definition.